Big Bonanza for residents as state government announces one time settlement (OTS) policy for pending property tax

In a major relief for the residents, the state government has announced one time settlement (OTS) policy for the pending property tax. The notification regarding the same has been issued by the state government.

Ludhiana, September 18, 2023: In a major relief for the residents, the state government has announced one time settlement (OTS) policy for the pending property tax. The notification regarding the same has been issued by the state government.

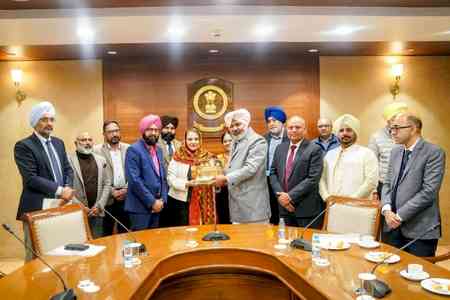

Sharing the information regarding the notification issued by the government at MC Zone D office in Sarabha Nagar on Monday, MLA Madan Lal Bagga, MLA Ashok Prashar Pappi, MLA Gurpreet Bassi Gogi and MC Commissioner Sandeep Rishi among others stated that the state government has announced a big bonanza for residents under this OTS policy.

As per the norms, the residents, who have not paid property tax in the past are liable to pay 20 percent penalty and 18 percent annual interest on pending property tax.

But under this OTS policy, the residents can now pay the pending tax in lump sum without penalty and interest by December 31, 2023. A 100 percent penalty and interest waiver has been announced by the state government.

MLAs Madan Lal Bagga, Ashok Prashar Pappi and Gurpreet Bassi Gogi stated that Aam Aadmi Party (AAP) led state government has moved another step forward for providing relief to the residents.

If in any case, the residents are not able to pay the pending tax by December 31, 2023 in lump sum, the residents would then be eligible for 50 percent penalty and interest waiver on payment of lump sum tax from January 1, 2024 to March 31, 2024. After March 31, 2024, the residents will have to pay full penalty and interest on the pending property tax as per the norms.

The legislators stated that AAP led state government is working for the betterment of the state. The residents should take benefit of the policy and submit their pending tax without any penalty and interest by December 31, 2023.

(sub head) Residents can also avail 10 percent rebate on payment of tax for current financial year:

The MLAs and civic body officials stated that the residents can also avail 10 percent rebate on payment of property tax for the current financial year (2023-24) by September 30.

The civic body officials stated that the 10 percent rebate is being given only on the payment of property tax for the current financial year (2023-24).

City Air News

City Air News