Manappuram Finance Ltd posts 58 % rise in gold loan AUM

Declares an Interim Dividend of Rs. 0.50 (25%) per Equity Share of the Face Value of Rs. 2 each

Valapad, Thrissur, January 30, 2026: Manappuram Finance Ltd, a leading player in the NBFC sector, on Thursday announced its financial results for the December quarter (Q3 FY26). The Company reported a stable 58.15% year-on-year rise in gold loan Assets Under Management (AUM) on a consolidated basis.

In Q3 FY26 the company clocked Rs 38,754.29 crore gold loan AUM, while in the Q3 FY 25 the gold loan AUM was Rs 24,504.30 crore. The total AUM of the company for the quarter under consideration was Rs 52,125.31 crore, which is an increase of 17.88 % over Rs 44217.40 crore clocked in Q3 FY 25. Non-gold loan businesses accounted for 28 .74% of the total AUM.

For Q3 FY26 the income from operations marginally dipped by 8.07 % to Rs 2,353.14 crore, while in the year ago quarter it was Rs 2,559.72 crore. For Q3 FY 26 the PAT ( before OCI & minority interest) was Rs 238.54 crore while in Q3 FY 25 it was Rs 278.46 crore. For the quarter under consideration the number of branches stood at 5,351 and employee strength stood at 43,044.

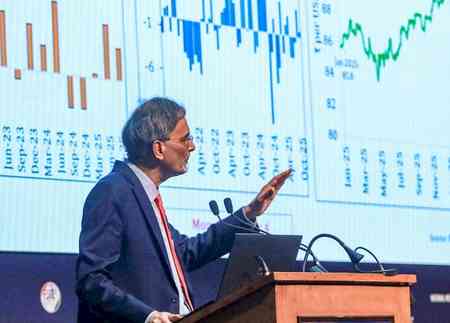

V.P. Nandakumar, Chairman and Managing Director, Manappuram Finance, said: “The third quarter of FY26 was marked by a steadily improving operating environment, even as competitive intensity remained elevated across the NBFC sector. Against this backdrop, we delivered a stable and strong performance.

Our core gold loan business continued to demonstrate resilience, supported by healthy customer demand and favourable gold prices, while our non-gold segments made steady progress in line with our calibrated growth strategy. Asset quality remained under control, and we maintained a disciplined approach to risk management, liquidity and capital allocation.

As we move into the final quarter of the year, our focus remains on sustainable growth, further strengthening our diversified portfolio, and enhancing customer experience, while continuing to deliver consistent value to our shareholders.”

City Air News

City Air News