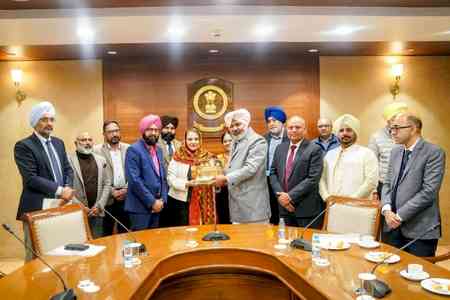

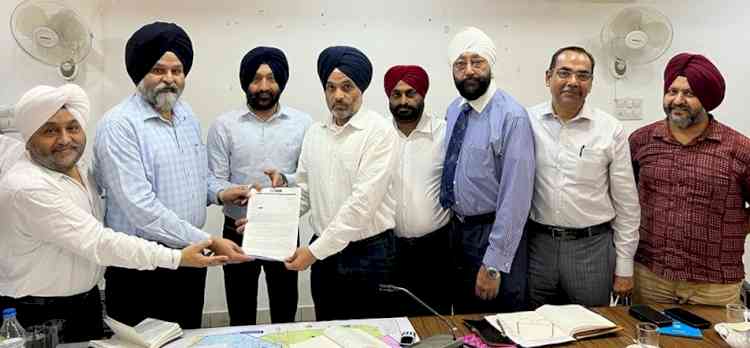

Joint delegation of FICO and UCPMA meets Taxation Commissioner and demands OTS for VAT pending cases

A Joint Delegation of Federation of Industrial & Commercial Organization (FICO) and United Cycle & Parts Manufacturers Association (UCPMA) under the leadership of Gurmeet Singh Kular President FICO met Arshdeep Singh Thind Taxation Commissioner and HPS Ghotra Director GST Punjab, Ravneet Singh Khurana Additional Commissioner Taxation and Audit, Government of Punjab; and put forward demands for immediate resolution.

Ludhiana, September 12, 2023: A Joint Delegation of Federation of Industrial & Commercial Organization (FICO) and United Cycle & Parts Manufacturers Association (UCPMA) under the leadership of Gurmeet Singh Kular President FICO met Arshdeep Singh Thind Taxation Commissioner and HPS Ghotra Director GST Punjab, Ravneet Singh Khurana Additional Commissioner Taxation and Audit, Government of Punjab; and put forward the under-mentioned demands for immediate resolution.

• One-Time Settlement Scheme:

It is also requested that to launch the special One Time Settlement Scheme @ 1% if C forms & H forms are not available from the dealers from other states. The industry can get their cases submitted at nominal charges; this will not only be beneficial for the industry but also will generate some extra revenue for the government. The industry is not in a position to pay any interest or penalty due to the known reason.

• Pending VAT Refunds before GST Period:

The VAT refunds which range in huge amounts are still pending with the government. Even after the completion of assessments & issuances of various Circulars in the previous times, the relief has yet to reach at doorsteps of the industry. This shortfall in Working Capital funds has landed the industry in the trap of loans & interest leading to a vicious circle of Capital erosion. It is requested that the Pending VAT Refunds should be released on priority.

• Input Tax Credit on Capital Goods:

The major bottleneck that remains for the Industry is the restriction on refunds on account of Capital Goods, As per the provisions of Rule 89(5) the ITC on Capital Goods has been excluded from the calculation of the Refundable amount. It implies that the GST paid on procurement and installation of Plant and Machinery remains unutilized forever in the hands of manufacturers and causes a permanent blockage on the working capital of the industry.

• Adjustment of SGST, CGST and IGST paid under the wrong heads:

The GST law provides that if inadvertently or otherwise, SGST or CGST has been paid as IGST or vice versa, the registered person should claim a refund for the same and again make the payment under the correct head. There should be a mechanism to allow the registered persons to adjust on their own in their returns.

• Utilization of ITC:

In many cases of the utilization of ITC, the taxpayer had to pay CGST although he has the credit of SGST available. GST being one nation one tax, set off of SGST may be allowed against CGST to further the ease of doing business and also ease the working capital requirement of the taxpayer, there being no loss to the revenue.

• Minimum Floor Price for Mobile Wing:

Recently, it has been observed that the Mobile Wing of the GST Department is very vigilant and surveillant; the problem arises when any discrepancy is found and the mobile wing penalizes the defaulter with unjustified rates at their will, which is totally unjustified, and a standard minimum floor price should be fixed to avoid the discretion in the penalty being charged to the defaulters.

• Rejection of ITC in case of defaulter supplier:

ITC cannot be denied for the reason that the supplier registration has been cancelled with retrospective effect, even if the supplier is found fake or non-existent, ITC cannot be denied. The Calcutta High Court has passed the judgement favouring the same on July 07, 2023.

Amongst present were Gurmeet Singh Kular President FICO, Harsimerjit Singh Lucky President UCPMA, Avtar Singh Bhogal Senior Vice President UCPMA, Rajeev Jain General Secretary FICO/ UCPMA, Charanjit Singh Vishwakarma Former President UCPMA and Gurvinder Singh Sachdeva Head FICO Trade Division.

City Air News

City Air News