Golden opportunity for coverage under ESIC without any retrospective penalty through SPREE Scheme

It is well known that the Employees’ State Insurance Corporation (ESIC) has launched the SPREE (Scheme for Promoting Registration of Employers & Employees) from 1st July, which will remain in force until 31st December 2025. This scheme provides a one-time opportunity to employers to register their establishment/institution/factory, etc. (as an employer) along with such employees who have so far remained outside ESIC coverage.

Ludhiana, December 4, 2025: It is well known that the Employees’ State Insurance Corporation (ESIC) has launched the SPREE (Scheme for Promoting Registration of Employers & Employees) from 1st July, which will remain in force until 31st December 2025. This scheme provides a one-time opportunity to employers to register their establishment/institution/factory, etc. (as an employer) along with such employees who have so far remained outside ESIC coverage.

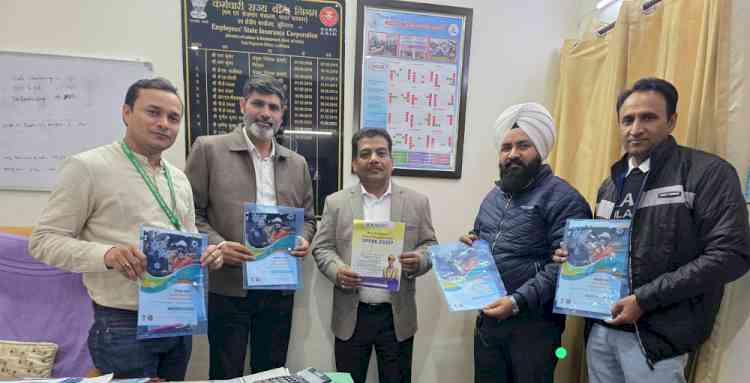

In this regard, to disseminate information among accountants in Ludhiana, a meeting was organized on 03.12.2025 by the Employees’ State Insurance Corporation, Ludhiana, in collaboration with the Ludhiana Accountants Welfare Association at the premises of the Sub-Regional Office.

At the seminar, Pranesh Kumar Sinha, Joint Director (In-charge), ESIC Ludhiana, welcomed all participants. He briefed them about the SPREE scheme and informed them that the scheme has been implemented to promote registration of employers and employees.

Under this scheme, employers registering their establishments will be considered covered from the date declared by them or the date of registration. Newly registered employees will also be considered covered from their date of registration. No past dues or penal action shall be applicable on coverage taken during the scheme period (1 July 2025 to 31 December 2025).

Additionally, employers who are already registered with ESIC but have certain coverable employees who were left out of registration for any reason may also register such employees under this scheme. By doing so, they will be fully exempted from past liabilities or penalties. Registration under the scheme can be done online through the Shram Suvidha Portal (https://shramsuvidha.gov.in) and the ESIC Portal (https://esic.gov.in).

During the seminar, participants were also briefed about the provisions of the new Labour Codes implemented from 21 November along with the SPREE scheme.

From the Accountant Association, Naresh Chalgotra (President), Avtar Singh (Vice President), and Ashok Chaudhary (Secretary) were present. Naresh Chalgotra assured that he would inform as many employers as possible so that all eligible employers and their employees may avail the benefits of the SPREE scheme.

City Air News

City Air News