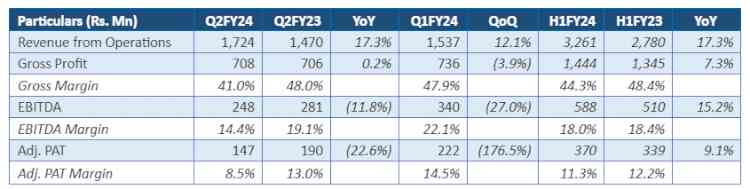

AMI Organics Limited reports Q2 and H1FY24 Results H1FY24 Revenue from Operations up

17.3% YoY to Rs. 3,260mn, H1FY24 EBITDA up 15.2% YoY at Rs. 588mn; EBITDA Margins at 18%

Surat, November 9, 2023: Ami Organics Limited (AMI) (BSE: 543349, NSE: AMIORG), a leading global manufacturer of advance pharmaceutical intermediates and specialty chemicals, today announced financial results for the quarter and half year ended September 30, 2023.

Commenting on results, Naresh Patel, Executive Chairman & Managing Director, Ami Organics Limited, said: “I am pleased to report a 17% YoY growth, with a revenue from operations of Rs. 172 crores for the quarter, despite facing downward pricing pressures. Even as we navigated the low demand landscape and delivered growth, our margins took a hit this quarter driven by high pricing pressure and higher sales of low margin products. Still, our strong order book point to a robust second half of FY24.

On the business front, Advance Pharmaceutical business delivered steady growth of ~8% YoY, even as for one product, a global customer delayed the launch in certain markets impacting our growth for the quarter. Further extending our relationship with Fermion, we have signed one more contract for Advanced Intermediates for their product taking total products under the CDMO contract to 3, enhancing revenue visibility for the coming years.

On the Specialty chemicals side, we delivered strong 72% growth YoY, driven by robust volume. The launch of a new UV Observer product is set to enhance our portfolio, contributing to our financials from Q3 FY24.

In our commitment towards sustainability and operational cost reduction, the board has approved investment in a 16 MW solar power plant which along with already work in progress 5 MW solar power plant will nullify our electricity expense once fully operational.

Deferment in product launch in certain markets by a global customer coupled with pricing pressure due to oversupply from China is expected to have some impact on the numbers and even though we are expecting to deliver robust H2 FY24, overall, we are modifying our growth target from 22-25% for the full year to 18-22% growth for FY24.”

City Air News

City Air News