Business

Govt hikes import duty on gold and silver coins, jewellery...

The government has raised the import duty on gold and silver findings as well as...

L&T order book swells with big domestic and global deals

Construction and engineering giant Larsen & Toubro (L&T) announced on Tuesday that...

Zee shares now down 30% in a single trading session

Zee Entertainment shares are now down a massive 30 per cent in a single trading...

Infogain appoints Dinesh Venugopal as new CEO

Infogain, a Silicon Valley-headquartered leader in human-centred digital platforms...

Byju’s revenue reaches Rs 5,298 cr in FY22, losses surge...

The edtech major Byju’s on Tuesday announced its audited FY22 financial results...

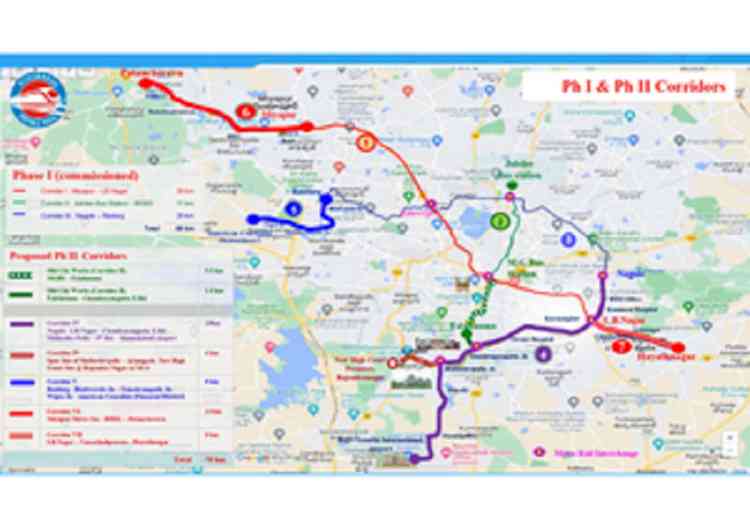

Hyderabad Metro's second phase to have four new corridors

Hyderabad Metro Rail Ltd (HMRL) has prepared a new route map for the second phase...

'Undervalued imports of knitted fabric from China impacting...

Representatives of associations and trade bodies have raised concern over the substandard...

Report by CRIF High Mark & DLAI highlights that Consumer...

CRIF High Mark, a leading Indian credit bureau, in collaboration with Digital Lenders...

ITC’s Aashirvaad Svasthi Ghee to spread ‘Aro-ma of Love’...

During the sacred occasion of the Pran Pratishtha ceremony at the Lord Ram Mandir...

Higher capital gains tax possible post-2024 elections:...

Though an immediate tax hike is not expected, considering elections, some post-election...