Tushar Rane joins Knight Frank India as Executive Director - Capital Markets (Core Assets)

Author(s): City Air NewsTushar Rane, Executive Director - Capital Markets (Core Assets), Knight Frank (India) Pvt. Ltd. Pune, November 6, 2017: Knight Frank India, one of the leading International Property Consultants has inducted an industry...

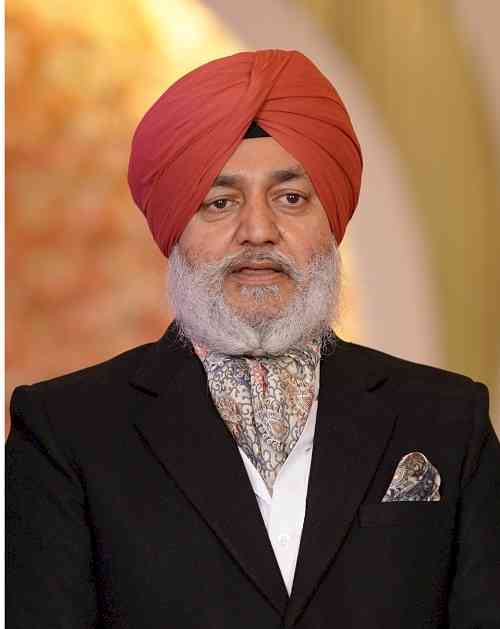

Tushar Rane, Executive Director - Capital Markets (Core Assets), Knight Frank (India) Pvt. Ltd.

Pune, November 6, 2017: Knight Frank India, one of the leading International Property Consultants has inducted an industry veteran to further fortify its leadership team.

Tushar Rane has joined Knight Frank India as Executive Director - Capital Markets (Core Assets) reinstating Knight Frank’s focus to diversify the Capital Markets business.Rajeev Bairathi, Executive Director – Capital Markets (Corporate Finance) will continue to lead the Corporate Finance business vertical for Knight Frank India.

Tushar is a seasoned real estate expert with over 25 years of experience. For the past couple of years he has been managing his entrepreneurial venture. Earlier he had essayed different roles at HSBC Bank, Centrum Realty and Infrastructure and ICICI Bank.

“Capital Markets is a key service line for Knight Frank globally. The recent spate of reforms in India such as the Real Estate Investments Trusts (REITS) has infused significant confidence among institutional funds which has reflected in their growing interest into core assets and the real estate sector on the whole. Going forward it would be prudent to capitalise on the massive potential. In light of this dynamic scenario I am sure that Tushar will bring the right blend of experience and energy to discover new avenues of growth in sync with our holistic business goals. His foray into our leadership league would add a new dimension to our presence in the industry,”said Shishir Baijal, Chairman and Managing Director, Knight Frank India.

Tushar Rane adds, “India’s real estate sector is headed towards its vertex with regards to attracting global capital flows. We have already witnessed the foray of international investment giants into the core assets business with the Real Estate Investments Trusts (REITs) and Infrastructure Investments Trusts (InvITs) becoming a reality. This is a great opportunity to be part of the buoyant and competitive business environment.”

cityairnews

cityairnews