Premium office occupancy cost of Delhi’s Connaught Place is higher than San Francisco: JLL

At an average cost of USD109 per sq ft per year, Delhi leads, with Mumbai’s BKC a close second at USD102 per sq ft per year

Mumbai, December 14, 2021: The heart of the National Capital - Connaught Place is home to premium buildings and remains the most expensive office market in the country. According to the JLL’s Premium Office Rent Tracker (PORT), Connaught Place in Delhi has climbed up the rankings from 25th position last year to 17th this year with an average occupancy cost of USD109 sq. ft. per year which is higher than San Francisco.

JLL’s Premium Office Rent Tracker (PORT) compares occupancy costs for premium office buildings across the world’s leading real estate markets. This seventh edition includes 127 office markets and submarkets in 112 cities. Occupancy costs can be simply understood as the cost of the net leasable area (actual rentable area) and include all costs for an occupier including the rent (effective rent payable after considering rent-free period, tenant improvement allowances), service charges (maintenance, etc.) and government taxes payable on the rent.

Mumbai’s BKC with an annual occupancy cost of USD 102 per sq. ft. is the second most expensive Indian city office market. It has slipped one position down to 23rd from last year.

The central business district (CBD) of Mumbai stands at 63rd position with an annual occupancy cost of USD 58 per sq. ft.

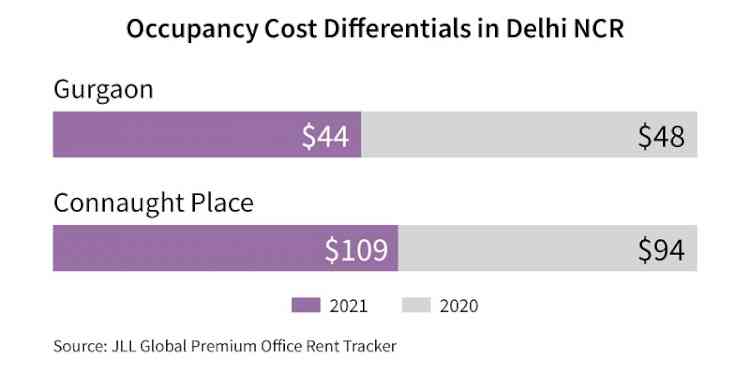

Occupancy costs remained stable at USD 51 per sq. ft. per year for Bengaluru, while it slid down to 77th place from 74th place last year. Occupancy costs in Gurgaon, Delhi NCR decelerated from USD 48 per sq. ft. per year to USD 44 per sq. ft. per year, moving it to 91st position from 83rd last year.

“The growing significance of limited availability and moderate construction pipelines are driving the prime market occupancy costs to new heights. Delhi and Mumbai continue to dominate the overall premium office occupancy costs in India. Bengaluru and Gurgaon have the advantage of relatively lower rentals compared to global markets with access to a large talent pool which also fuels the entrepreneurship startup eco-system. This makes both the cities attractive to international occupiers in search of premium quality office space with relatively lower occupancy costs,” said Rahul Arora, Managing Director, Bengaluru and Head, Office Leasing Advisory, India, JLL

If affordability is considered, Chennai with an occupancy cost of USD 21 per sq. ft. per year is the 4th most affordable office market globally reinforcing its reputation as amongst the cheapest destinations for firms to set up operations.

“In the country, except Connaught Place in Delhi, and Bengaluru, all other major office market rental values have contracted. The softening of rents was largely on account of the economic disruption in the wake of the second wave of Covid-19 and landlords being flexible for existing and new tenants during rent discussions. Bengaluru has proven to be relatively resilient to rental decline because of its high growth, low-cost dynamics compared to global markets. It remains the most preferred IT/ITeS destination in India and will continue to maintain its pole position amongst the key office markets. Bengaluru offers occupiers a strong talent pool with quality supply within the right rental budget and other support services for the IT/ITeS sector to thrive,” said Dr. Samantak Das, Chief Economist and Head of Research & REIS (India), JLL.

Globally prime office rentals across the world have fallen since 2020 by 0.8% in local currency terms.

The global office occupancy costs aren’t very different this time in comparison to the same time last year. The number one spot belongs to not one but two cities. Hong Kong (Central) and New York (Midtown) are the joint leaders in the most expensive markets on the Premium Office Rent Tracker research report. These cities at USD 261/ sq. ft./year occupancy costs continue to lead the rankings propelled by the banking and finance sectors.

BFSI and Global Capability Centres driving premium building rents in India

India’s premium markets of Connaught Place and Mumbai BKC are driven largely by banking and financial services firms, which is in line with the global trend.

The banking and financial services industry is amongst the top occupiers of the premium office space globally with a 42% market share in all markets. Technology firms on the other hand are progressively driving the sector even more than before with a 17% market share globally in the high-end markets. In Bengaluru’s case, Global Capability Centres and technology companies are key occupier segments in its premium markets.

Agents of Change

Sustainability is changing the office market globally

The report notes a clear trend across the premium office buildings surveyed: 84% of all premium buildings have some environmental sustainability certification and this rises to 100% in high-end markets. Although only 13% of the lot has a health and wellness certification, this will soar up with the tenants demanding healthy building credentials.

Moving forward, organisations` will focus on high-value sustainability initiatives to improve processes and drive growth which in turn will be a major driver in the premium office building markets. Green shoots are emerging with vaccination milestones being achieved and government restrictions loosened. The path to recovery although uneven is optimistic with many variables at the country level. As India is learning to live with Covid, occupiers are more forward-looking in comparison to the same time last year.

cityairnews

cityairnews