PHDCCI Quick Economic Trends for April 2021

Pandemic impacts economic recovery with disruption in supply chain and contraction in demand: PHD Chamber

Re-emergence of COVID-19 cases in India and resultant partial lockdowns and curfews in many parts of the country in the month of April 2021 have impacted the pace of economic recovery with disruptions in supply chains and contraction in demand. The storm like spread of pandemic will have impact on the anticipated double digit GDP growth trajectory in 20211-22, said Sanjay Aggarwal, President, PHD Chamber of Commerce and Industry, in a press statement issued here today.

The low base effect along with strong pace of economic recovery had created a great hope of double digit growth in 2021-22, however, the pandemic has created emergent signs of slowdown, said Sanjay Aggarwal.

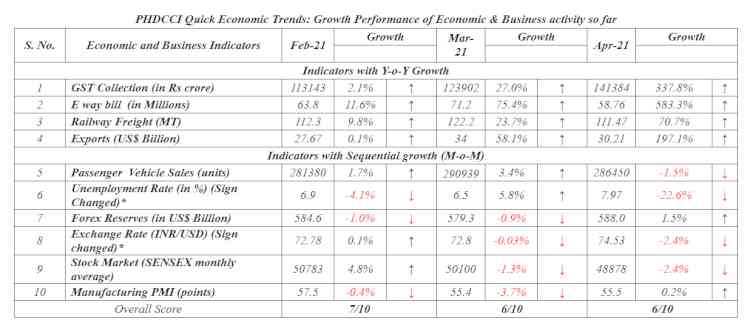

Out of the 10 economic and business indicators of QET (Quick Economic Trends) tracked by the industry body PHDCCI, only 6 have performed positive in April 2021 including GST collections, e-way bills, railway freight, exports, forex reserves and manufacturing PMI.

E-way bills has shown a highest growth of 583% over the corresponding month in previous year on a low base effect of April 2020, followed by GST collections with growth of 338% over the same period, said Sanjay Aggarwal.

However, 4 indicators including passenger vehicle sales, unemployment rate, exchange rate and stock market registered a decline in April 2021 over the previous month of March 2021, said Sanjay Aggarwal.

The second wave of Covid-19 has struck like a storm throughout the country, setting new records of daily cases, active cases and deaths. People are channelizing their savings towards the medical expenses of their family members, said Sanjay Aggarwal.

The entire economic activity is severely impacted with the closure of offices and shops. Pandemic COVID-19 have significantly influenced the buying behaviour of the consumers as many have postponed their larger expenditures such as purchase of vehicles, electronics, among others, said Sanjay Aggarwal.

Pandemic COVID-19 has created uncertain economic conditions causing contraction in demand and subdued investment activity in the country which is posing a downside risk to the economic activity in the coming months, said Sanjay Aggarwal.

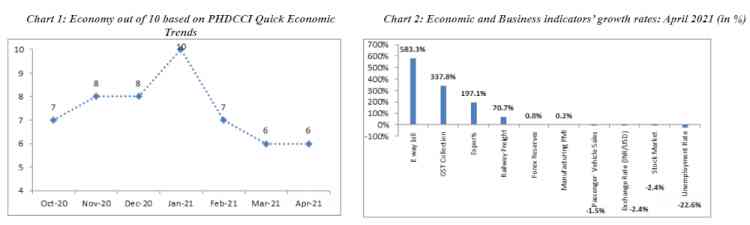

The significant pick up in the economic activity was observed from October 2020 which peaked in January 2021 and have started declining from February 2021 as depicted in the Chart-1, said Sanjay Aggarwal

Source: PHD Research Bureau, PHDCCI

Source: PHD Research Bureau, PHDCCI

Note: Growth calculations of indicators such as exchange rate and unemployment are adjusted such that the decrease in the said indicators depicts improvement and vice-versa; figures are rounded off; year on year (y-o-y) growth is calculated for the indicators including GST Collection, E way bill, Railway Freight and Exports; sequential (month over month) growth is calculated for the indicators including Unemployment Rate, Forex Reserves, Exchange Rate, Stock Market, Passenger Vehicle Sales and Manufacturing PMI.

10 economic and business indicators of QET include demand and supply indicators along with external and financial sectors indicators, said Sanjay Aggarwal.

Economic and business indicators such as GST Collections, E-way Bills, Railway freight and Exports have shown a positive y-o-y growth in April 2021 as compared with April 2020, while forex reserves and manufacturing PMI registered an improvement in April 2021 over the previous month March 2021, said Sanjay Aggarwal.

Source: PHD Research Bureau, PHDCCI, compiled from various sources

Source: PHD Research Bureau, PHDCCI, compiled from various sources

Note : *Growth calculations of indicators such as exchange rate and unemployment are adjusted such that the decrease in the said indicators depicts improvement and vice-versa; figures are rounded off; YoY means Year on Year growth and MoM means month over month (sequential) growth.

At this juncture, rapid administration of COVID-19 vaccination becomes crucial to resume the pace of economic momentum, said Sanjay Aggarwal.

Further, immediate policy attention is required towards credit access to industry particularly to the MSMEs. Credit disbursement should be the top priority at this juncture by the banking sector. The focus should be on ensuring provision of hassle free disbursements of loans vis-à-vis enhanced liquidity for MSMEs, said Sanjay Aggarwal.

Also, there is a need to lower interest rates for consumers and businesses, lesser compliances for MSMEs vis-à-vis ease of doing business at the ground level, said Sanjay Aggarwal.

A substantial stimulus to create effective strides for futuristic growth trajectory for Indian Economy and for diminishing the daunting impact of the second wave of the pandemic covid-19 on economy, trade and industry would be crucial to support the economic momentum in this extremely difficult time, said Sanjay Aggarwal.

cityairnews

cityairnews