Mumbai strengthens its position as India’s data centre capital: Knight Frank

Knight Frank, in its latest report- Asia-Pacific Data Centres 2025, highlights Mumbai’s rise as India’s data centre capital. According to the report, the city leads India’s data-centre landscape accounting for 40% of total national capacity and 44% of live IT capacity.

Mumbai, September 19, 2025: Knight Frank, in its latest report- Asia-Pacific Data Centres 2025, highlights Mumbai’s rise as India’s data centre capital. According to the report, the city leads India’s data-centre landscape accounting for 40% of total national capacity and 44% of live IT capacity.

In H1 2025, Mumbai’s capacity rose 14.3% to surpass the 4GW milestone, with 591MW operational, 185MW under construction, and 3.2GW in the pipeline. This growth builds on India’s data centre market surpassing 10GW in H2 2024, supported by 1.4GW live and 400MW under construction.

Rapid cloud adoption, increasing data localisation requirements, as well as the growth of local fintech and BFSI firms has been fuelling data-centre demand. Over the past six months, Mumbai recorded 97.6MW of take-up. This has translated to a tight vacancy rate of just 5.4% vs. India’s overall colocation vacancy rate at 12.3%. Demand-side commitments seem resilient with absorption broadly keeping pace with the multi-fold growth in supply over the past years. Also, two-thirds of Mumbai’s capacity under construction at present is already pre-leased.

Yet, with just three live sites currently capable of supporting hyperscale deployments (>2.5MW) and only one site with available capacity of more than 10MW, there seems to be a short-term supply tightness for big-ticket requirements. Distribution of available live capacity is skewed toward smaller deployments: 10 sites offer <1MW, 5 sites fall in the 1–2MW range, while only 3 sites provide >3MW.

Such fragmented deployments are opening doors for well-capitalized global players and joint ventures to deliver high-capacity facilities in the region that is currently dominated by local players. The 500MW NAV2 campus announced by NTT and another 500MW AI facility by Blackstone-Panchshil Realty are case in point.

Also, operators with large-scale requirements are exploring alternative markets. Hyderabad is positioning itself as a hyperscale-first market, with over 500MW of new data centre capacity currently in the pipeline through two projects. STT GDC India has signed an MoU with the Telangana government to develop a 100MW campus, while NTT has committed INR 10,500 crore (approximately USD 1.25 bn) to establish a 400MW AI-focused data centre campus.

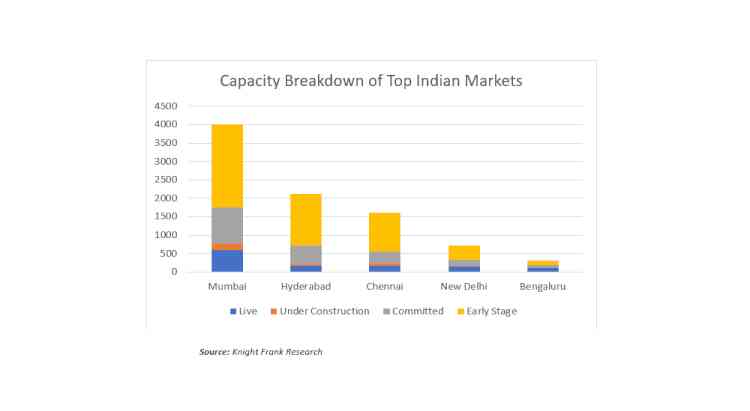

Hyderabad is the second largest data centre market in India with 2.1GW of total capacity, followed by Chennai (1.6GW), New Delhi (712MW) and Bengaluru (307MW).

Shishir Baijal, Chairman and Managing Director, Knight Frank India, said: “Mumbai has firmly established itself as the epicentre of India’s digital infrastructure growth. With over 3GW of capacity in the pipeline and strong policy support for green data centre parks, the city is attracting sustained global investment. As cloud adoption and AI workloads accelerate, Mumbai’s unique strengths, its robust subsea cable connectivity, scalable power infrastructure, proximity to enterprise hubs, and progressive state policies are consolidating its position as India’s data centre capital. While other metros like Chennai, Hyderabad, and Bengaluru are gaining traction, none match Mumbai’s scale, speed, and ability to serve as South Asia’s gateway for cloud, AI, and enterprise workloads.”

City Air News

City Air News