Liberty General Insurance appointed as Lead Non-Life Insurer for Delhi under IRDAI’s State Insurance Plan

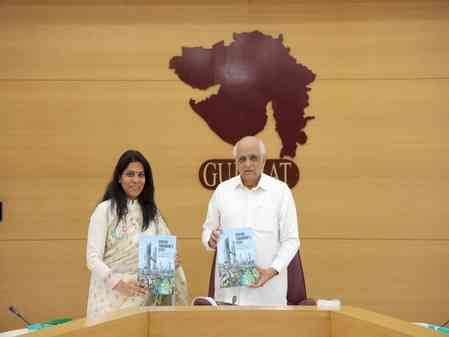

Liberty General Insurance, one of the leading non-life insurance companies in India, has been appointed as the “Lead Insurer” for Delhi by the Insurance Regulatory and Development Authority of India (IRDAI). This appointment is part of IRDAI’s State Insurance Plan, which aims to enhance financial awareness and drive insurance inclusion in collaboration with other insurers.

Mumbai/Delhi, July 27, 2023: Liberty General Insurance, one of the leading non-life insurance companies in India, has been appointed as the “Lead Insurer” for Delhi by the Insurance Regulatory and Development Authority of India (IRDAI). This appointment is part of IRDAI’s State Insurance Plan, which aims to enhance financial awareness and drive insurance inclusion in collaboration with other insurers.

IRDAI’s decision to identify Liberty General Insurance as the lead insurer (Non-Life) for Delhi is a strategic move to improve insurance awareness and penetration across the state. The initiative aligns with IRDAI’s mission of “Insurance for All by 2047” and aims to ensure last-mile delivery of insurance services to the uninsured population of Delhi.

Speaking on this important development, Roopam Asthana, CEO & Whole Time Director, Liberty General Insurance said, “We are excited to be appointed as the Lead Insurer and look forward to working closely with our colleagues in other non-life and health insurance companies, the insurance regulator, and the Government of Delhi to raise awareness and penetration of insurance to ensure financial protection for individuals and businesses alike. A financially protected Bharat is India’s next big milestone. Liberty is committed to empowering our heartlands by partnering with the State Government and local bodies to offer insurance solutions to the populace. With this important initiative we aim to bridge the insurance gap between rural and urban India and create a financially secure future for all citizens.”

As the lead insurer, Liberty General Insurance will collaborate with all non-life and health insurance companies operating in Delhi, as well as with IRDAI and the State Government, to create awareness of existing government schemes and enhance insurance reach and accessibility across the state, including at the district, and state levels.

The company continues to drive insurance awareness conversations and campaigns across various regions and social media platforms. Liberty General Insurance believes in empowering individuals through educational initiatives and campaigns that promote awareness about insurance products and their benefits. In the past, the company has adopted an approach of imparting financial literacy and making people aware of insurance as an essential financial tool in simpler ways in prime districts like Birbhum & Latehar.

To further promote insurance awareness, Liberty General Insurance recently collaborated with Canara HSBC Life Insurance to conduct Nukkad Natak (Street Play) performances at 30 different locations in New Delhi, emphasizing the importance of insurance. During the campaign, the company distributed over 3000 handouts highlighting the significance of insurance in everyone’s life.

With Delhi’s strong socio-economic profile, the need for increased insurance adoption is vital to reduce the protection gap and support sustainable economic development within the state. Liberty General Insurance is committed to contributing to this vision and plans to strengthen its presence in Delhi, as it already serves millions of customers nationwide.

Currently, Liberty General Insurance operates in 100+ locations across 29 states and UTs, with a partner network consisting of about 6000+ hospitals and more than 5000 auto service centers.

City Air News

City Air News