JLL’s latest Global Real Estate Transparency Index reveals significant improvement in India

The country has bagged the 34th position on the Index and is one of the top improvers globally and regionally

Delhi: India’s real estate industry has registered one of the largest improvements globally and regionally in JLL and LaSalle’s biennial Global Real Estate Transparency Index (GRETI). The country ranks 34th globally on the index, with higher levels of transparency observed in India due to regulatory reforms, enhanced market data and sustainability initiatives.

This improvement is led by the progress in the country’s REIT framework attracting greater interest from institutional investors. India has also edged into the top 20 for Sustainability Transparency through the active role of organizations like the Indian Green Building Council and Green Rating for Integrated Habitat Assessment.

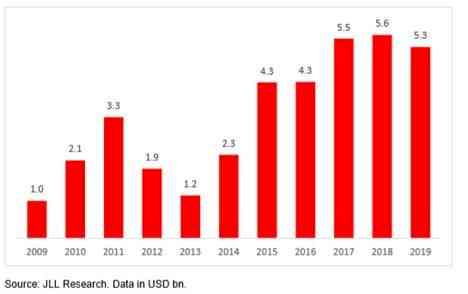

The 2020 Index is launched at a time of massive economic and societal disruption where the need for transparent processes, accurate and timely data and high ethical standards are in closer focus. The backdrop of COVID-19 is also ensuring that transparency within Asia Pacific’s real estate legal and regulatory systems is more important than ever to global investors as they look to deploy approximately $40 billion* in dry powder capital into the region.

“India has seen a steady improvement in the Global Transparency Index over the years. In fact, along with Indonesia, Philippines and Vietnam, we are among the handful of countries that have seen the highest improvement owing to positive governmental support and an enhanced ecosystem of transparency. In particular, the national REIT framework has been a major contributor to transparency in India, and with ongoing progress and governance, will continue to attract more interest from institutional investors,” said Ramesh Nair, CEO and Country Head (India) JLL. “Encouragingly, India has also edged into the top 20 for Sustainability Transparency through the active role of organisations like the Indian Green Building Council and Green Rating for Integrated Habitat Assessment. I see these as extremely positive signs of how much we have covered in the real estate sector and a strong base in which to build on transparency gains,” he added.

According to JLL, pressure exists from investors, businesses and consumers to further improve real estate transparency to compete with other asset classes and meet heightened expectations about the industry’s role in providing a sustainable and resilient built environment in the age of COVID-19. Furthermore, innovative new property technology (proptech) is changing how real estate data is gathered and analyzed and influencing industry transparency at a regulatory level.

“While investment into commercial real estate has inevitably paused during the pandemic, the overarching trend toward rising allocations to this asset class will continue. As investors look to allocate more capital into Asia Pacific real estate, transparency becomes fundamentally more important, as will the enforcement of robust regulatory frameworks,” said Dr. Samantak Das, Chief Economist and Head – Research & REIS, India, JLL.

Emerging markets have once again shown the greatest advancement in the Index, with six Asia Pacific markets – Mainland China (32nd), Thailand (33rd), India (34th), Indonesia (40th), Philippines (44th) and Vietnam (56th) – among the top 10 biggest improvers globally. Mature markets such as Australia (3rd) and New Zealand (6th) have maintained their positions near the top of the global ranking.

cityairnews

cityairnews