FADA Releases November’23 Vehicle Retail Data

The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for Nov’23.

Hyderabad, December 6, 2023: The Federation of Automobile Dealers Associations (FADA) today released Vehicle Retail Data for Nov’23.

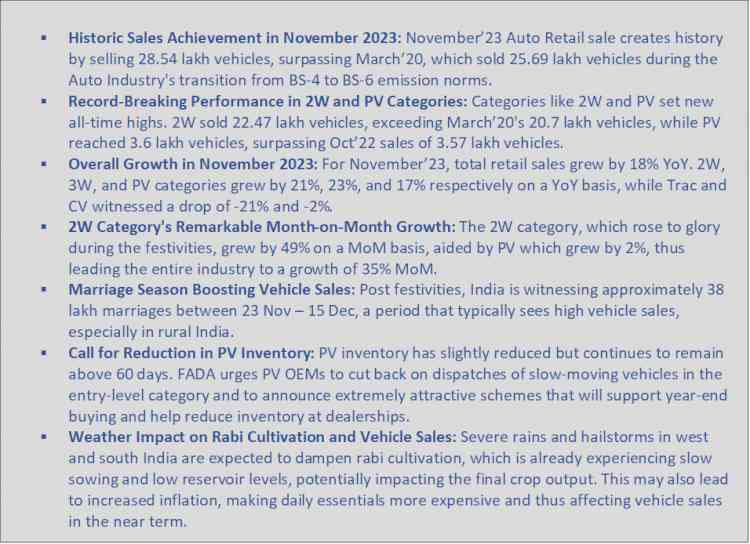

Commenting on November 2023 Auto Retails, FADA President, Manish Raj Singhania said, “November’23 has become a historic month for the Indian Auto Retail Industry as during the month, 28.54 lakh vehicles were sold, thus overtaking the previous highs of March’20 when the industry sold 25.69 lakh vehicles during the BS-4 to BS-6 transition. Apart from this, 2W and PV also created new records. The 2W category sold 22.47 lakh vehicles, an increase of 1.77 lakh vehicles compared to the previous high of March’20. The PV category also sold 3.6 lakh vehicles, ~4K vehicles more when compared to previous highs of October’22.

November’23 witnessed a YoY growth of 18% and MoM growth of 35%. While 2W, 3W, and PV showed growth of 21%, 23%, and 17% respectively on a YoY basis, Trac and CV fell by 21% and 2% YoY.

For the 2W category, the month witnessed a significant boost in auto retail, thus making it clock all-time high retails, buoyed by the festive excitement of Deepawali and enhanced by strong rural sentiments, thanks to thriving agricultural income. New product launches and better model supply further fuelled the market's growth, while electric vehicle sales demonstrated an encouraging upward trajectory.

The CV category saw a challenging Nov’23, driven by poor market sentiment. Seasonal slumps, exacerbated by unseasonal rains damaging crops and impacting transport demand, coupled with liquidity issues and delayed deliveries, further strained the industry. States going into elections also added to the woes, overshadowing the brief uplift from festive sales and the slight increase in tourism that helped in sales of buses.

November 2023 witnessed a strong surge in the PV category, primarily fuelled by Deepawali and the launch of new and appealing models. The improved supply chains, coupled with new launches, effectively catered to the festive demand, marking the peak point in sales. However, the period following the festivities saw a noticeable slowdown, coupled with a critical challenge of slow-moving inventory due to a mismatch in demand and supply which is still not resolved. This issue casts a shadow over the otherwise positive trends, highlighting the need for strategic adjustments in inventory management."

City Air News

City Air News