Exporters to gear up for difficult times with drop in demand globally particularly in advance economies: FIEO

Expresses confidence that government will do its best to support industry and exports sector in such challenging times

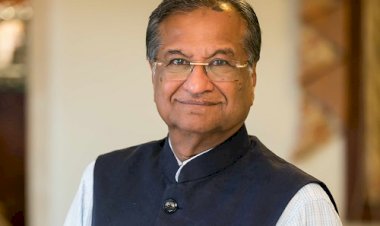

Ludhiana: The spread of Covid 19 to over 144 countries points to the most challenging times for the exports sector. The virus is likely to expand to many more countries. Near lock down and quarantine in many advanced economies has given a jolt to the demand and added to the rising uncertainties with looming recessions in large number of economies with consequent fallouts said Mr Sharad Kumar Saraf, President, FIEO.

President FIEO said that while we are emboldened by the Government statement that Coronavirus has hitherto not impacted Indian economy yet export sector has started feeling the pinch with many requests from buyers to hold back shipments till further instructions. We feel that a significant number of such requests may eventually lead to cancellation of orders. Even in cases where Indian exporters are adhering to the terms of contract, the force majeure clause are likely to be invoked by buyers to deny claim/liability raised by exporter, added Mr Saraf.

The MSMEs particularly in employment intensive sectors like carpets, handicrafts, apparels, footwear, gems and jewellery, marine and perishable with their major market in Europe and the USA are likely to be worst affected particularly in first quarter of FY 2020-2021, as per the current trend.

Mr Saraf said that he is confident that Government will do its best to support the industry and exports sector in such challenging times. However, since all businesses (with few exceptions) will take a hit in revenue and margins, with fixed cost remaining the same, we request the Government to consider the following, which may not cost the exchequer a lot:

1. Banks may be asked to delay the declaring companies’ accounts as NPA for 1 year as the lack of business coupled with fixed cost will make many accounts NPAs.

2. The existing working credit limits of exporters with the banks may be automatically enhanced by 25%, if so desired.

3. Collateral free lending upto Rs 2 Cr may be implemented in true spirit for MSME. The collateral requirement may be capped at 35-40% for lending beyond Rs 2 Cr.

4. All existing Export Promotion Schemes must continue till 31.3.2021 at least.

5. The Government may ease out the liquidity by immediately releasing all exports benefits to exporters including risky exporters for which a bond may be taken from risky exporters.

6. In the Foreign Trade Policy, the export obligation period under Advance Authorization and EPCG may be extended by 1 year.

7. Foreign Trade Policy may provide automatic revalidation to all duty-free authorizations by 1 year to enable the industry to import inputs at the right price.

8. RBI may extend the remittance period from 9 months to 15 months looking into the liquidity challenges and slow consumer spending.

9. Exemption from caution listing of exporters by RBI may be extended from 31.3.2020 to 31.3.2021.

10. Since participation in International shows will be relatively slow, the penal cuts on reduce level of participation may be waived under MAI Scheme of the DoC for 2020-21.

11. Encourage Indian missions abroad/EPCs to organise buyer-seller meets over video-conferencing particularly in respect of identified potential products in specified markets.

12. Provide suitable corpus to ESI to cover all workers who are given leave due to less business so that wage burden is not passed on to the industry.

President FIEO said that if situation improves rapidly in the second quarter of the next fiscal, Indian exporters may gain in some products so as to offset the losses. However, at this point of time, survival of many MSME exporting units looks challenging.

cityairnews

cityairnews