CNBC-TV18’s show invited industry experts to answer investor queries on managing their finances wisely amidst pandemic

The show invited industry doyens who shared their views about the impact of the pandemic on markets, investing in stocks, commodities and personal finance

Mumbai: As the nation gets set for Lockdown 4.0, it truly is an unprecedented time with industries across various sectors reeling in the effect of the lockdown. This disruption in the economy has given rise to viewers filled with queries aplenty with regards to their finances, how to safeguard their investments and what the future has in store. Catering to these growing doubts, CNBC-TV18, India’s leading English business news channel recently invited a host of industry doyens on their show ‘Money Money Money’ this week.

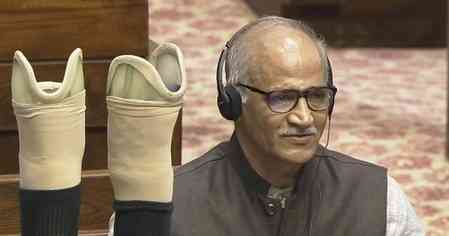

Hosted by Surabhi Upadhyay, the show provided an opportunity for its viewers to have their queries addressed and receive real-time feedback from the experts on the show. The show featured prominent names like Kshitiz Mahajan, Co-founder of Complete Circle Consultants; Adhil Shetty, Founder & CEO of Bankbazaar.com and Gaurav Mashruwala – a certified financial planner. The show saw Surabhi interact with the experts on various aspects regarding personal finance like creating a cash buffer, if shoring up insurance needs is required, how to best utilize your loans, loan moratoriums, the best commodities to invest in, personal finance, investing in gold amongst others that pertained to one’s investments.

Some of the commons questions asked to the experts included, ‘Are people still applying for a lot of loans or credit cards?’, ‘How can one keep an emergency fund ready for the unusual times?’, and ‘What if I do not have income for the next two months?’. Offering immense value through their industry insight, the experts provided actionable solutions like liquidate low yielding investments at the earliest, keep 5-7% of one’s portfolio in gold, maintain cash in bank FDs or high-yielding savings accounts, choosing loan moratorium, opt-out of credit risk funds for the time being, spilt savings across two different banks and maintain 3-6 months of income as emergency corpus amongst many others.

Reaching out to a large audience spanning the length and breadth of the country, the show helped people come forward and have their questions answered. Further points of discussion included impact of the pandemic on markets, investing in stocks, commodities and personal finance. The panel of experts also responded to questions posted on social media that included, ‘Is physical Gold more preferable investment compared to gold sovereign bonds, gold ETFs or digital gold? In the current scenario; gold or equity? Which is the best option to invest at these times? Where to invest money in such uncertain times? Which is the safest option out of equities, MF, ETS, Sovereign Gold Bonds and FDs? Given the uncertain times and people looking for high liquidity, which one is better: Digital gold being sold on various platforms like Paytm, Google Pay etc. or parking funds in Gold ETF?

cityairnews

cityairnews