Choosing the Right Online Trading Platform: 5 Key Factors to Consider

If you are looking to trade in stocks, derivatives, and more then opening an account with a robust online trading platform is quite crucial. With so many platforms available in the market, it is a challenging task to select the best one that matches your requirements.

If you are looking to trade in stocks, derivatives, and more then opening an account with a robust online trading platform is quite crucial. With so many platforms available in the market, it is a challenging task to select the best one that matches your requirements.

To help you with the same, in this article, we’ll see what are the five key factors you can base your decision on when considering the online trading platform.

5 Key Factors to Consider When Selecting the Online Trading Platform

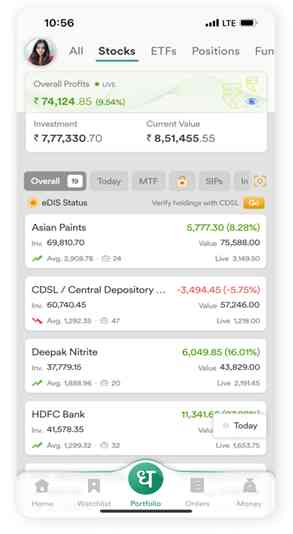

An online trading platform is a system that facilitates buying or selling different securities. These platforms are provided by various online stockbrokers that offer varied features such as market updates, charting analysis, portfolio management, smart mobile apps, etc. Here are the top five factors that you have to consider before making a decision about an online trading platform.

1. Easy-to-use Interface

The online trading platform should have an easy-to-use interface which means that you should be easily able to navigate between different securities, and charts, and get real-time market analysis.

An easy-to-use interface allows traders of all experience levels to leverage the features of the platform and trade easily and quickly.

2. Affordable Charges

There are different charges applicable whenever you buy or sell securities on an online trading platform or a share market trading app, such as brokerage charges, transaction charges, stamp duty, etc.

Therefore, you should select a stockbroker who has affordable charges and also offers other prominent functionalities such as real-time market updates, fast fund withdrawal availability, analytical views on your portfolio, and much more.

3. Security

Security is one of the most important factors to consider whenever selecting any online trading platform because you will give your personal or bank details to open an account.

You should choose an authorized or SEBI-registered stockbroker such as Dhan. There should be two-factor authentication, notification services on any outside logins, or regular updates to ensure full safety.

4. Multiple Trading Securities

An online trading platform should not just provide access to stocks but also allows you to trade in different securities such as ETFs, currencies, commodities, F&O, etc.

Hence, research well and select a stockbroker that helps you trade in multiple securities without much hassle and allow their tracking in a single place.

5. Accessible Customer Support

Customer support is one of the main features that need to be available on the online trading platform because sometimes, you may face issues while trading that need insistent assistance.

A trading platform should be offering customer support services in different ways such as chatbot, phone call, or email. While researching, also check the response time so that you do not face issues at a later stage.

Conclusion

These are the five most important factors that you should consider whenever choosing an online trading platform. To make an easy decision, you can check out the reviews or customer feedback to fully analyze the positive and negative points of any platform. If you are starting your trading journey and looking for a suitable platform, you can also consider Dhan. It ticks all the above boxes and offers much more to elevate your trading game.

City Air News

City Air News