Bank of Baroda and BNP Paribas Asset Management join forces to form asset management joint venture company

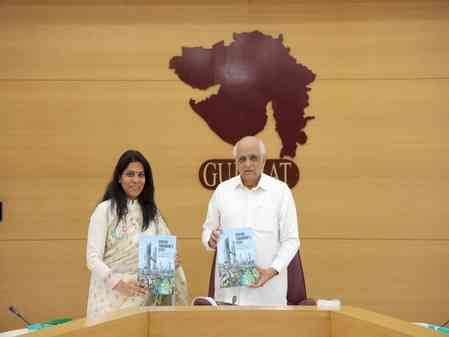

Baroda MF and BNP Paribas MF come together to form ‘Baroda BNP Paribas Mutual Fund’

Mumbai, March 14, 2022 – Bank of Baroda, one of India's leading public sector banks and BNP Paribas Asset Management - the asset management arm of BNP Paribas, a leading banking group in Europe with global reach, have entered into a strategic partnership by combining the strengths of their respective asset management businesses in India, to form ‘Baroda BNP Paribas Mutual Fund’.

The resulting jointly held Asset Management Company (AMC) will leverage on the strengths that each partner has developed, to offer products specifically designed for retail and institutional clients in India. This partnership demonstrates both institutions' commitment to the Indian market, and their desire to cater to the fast-evolving needs of the country's investors.

Bank of Baroda will have a 50.1% stake in the AMC, while BNP Paribas Asset Management will hold the remaining 49.9% stake.

Baroda BNP Paribas Mutual Fund will offer 28 schemes across equity, hybrid, debt and overseas fund of fund categories. With touch points in 90 towns and cities across India, it is expected to serve over 1 million investor folios and more than 10,000 distributors. The joint venture AMC will also provide offshore advisory services and has combined assets under management and advisory of INR 22,522 Crore as on 14th March 2022.

Suresh Soni has been appointed the CEO of the merged entity.

Commenting on the merger, Sanjiv Chadha, Managing Director & CEO, Bank of Baroda said, “This is the coming together of two financial powerhouses who complement each other with the strengths that they bring to the table, creating a more potent combined entity. BNP Paribas Asset Management is a leading global asset manager, backed by BNP Paribas, and the JV will leverage their global experience, expertise and processes to build a stronger asset management platform offering high-quality investment solutions at scale. We have a tremendous opportunity before us in the Indian asset management space and I am excited about the journey ahead.”

David Vaillant, Global Head of Finance, Strategy & Participations, BNP Paribas Asset Management said, “This strategic partnership will enable us to expand in terms of scale and client outreach, as well as to grow our distribution network, and will provide Baroda BNP Paribas Mutual Fund with our global experience in managing assets across more than 30 markets. The joint venture aims to build on the strengths of both partners to create greater synergies and operational efficiencies, as well as bringing a wider range of first-class investment solutions to Indian investors.”

Suresh Soni, CEO of the merged entity said, “The Indian mutual fund industry is witnessing strong growth. There is a wave of both experienced and new investors across economic strata who want to participate in the India growth story. This joint venture combines the complementary strengths of two partners - massive local reach and in-depth knowledge of the Indian market of Bank of Baroda with the global expertise of BNP Paribas Asset Management. It gives us an opportunity to serve investors and partners in not just ‘India’, but ‘Bharat’ too. Our aim is to deliver strong performance, by offering diverse and innovative investment solutions, combined with impeccable service to our investors to help fulfil their financial goals.”

cityairnews

cityairnews